Paying by direct debit is popular, convenient and relatively safe in Germany. The SEPA direct debit procedure also makes cross-border payments within the European Economic Area easier if they are denominated in the euro currency.

The most important thing in brief:

- The SEPA direct debit procedure has been in place since July 2012. This makes paying by direct debit in euros relatively safe.

- SEPA means “Single Euro Payments Area”, which stands for a unified European payment area.

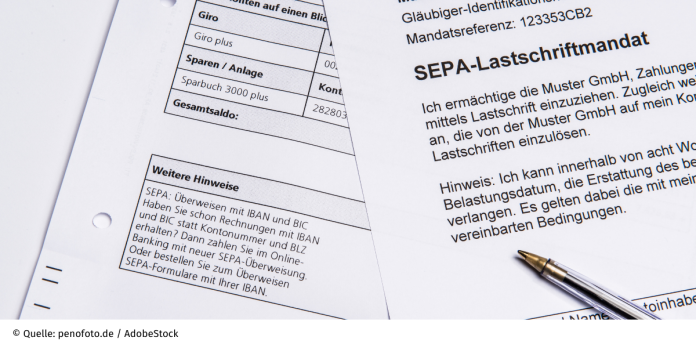

- If you want to pay a company by direct debit, you must give them a SEPA direct debit mandate.

This is how direct debits work in the SEPA procedure

Direct debits still exist in two variants: as SEPA core direct debits and as SEPA company direct debits. For you as a consumer, only the SEPA core direct debit is of interest. The Euro Payments Area includes the 27 member states of the European Union as well as Norway, Liechtenstein, Iceland, Great Britain and Northern Ireland, Monaco, Switzerland and San Marino as well as some non-European areas that belong to France.

For direct debits using the SEPA procedure, you as a customer expressly submit a double declaration. It's called a mandate: You authorize the provider in writing to collect and at the same time give your own bank permission to make the booking. Therefore, there should be no unauthorized direct debit bookings in this process.

Each SEPA direct debit mandate receives a unique mandate reference. The payee must provide them with every debit. You will see them on the bank statements. As a payer, you can track every debit from your account and compare it with the direct debit mandates that have been issued. The creditor identity number of the recipient of the payment and the intended purpose also help.

Payees are obliged to inform you of the amount and the time of debit at least 14 days in advance. This gives you the opportunity to ensure that your account has sufficient funds. A shorter period than 14 days is possible if this has been agreed in the general terms and conditions or the invoice.

Good to know: You can revoke a direct debit mandate at any time by submitting a written statement to the payee or his bank. It also makes sense to inform your own bank about this.

What cancellation and objection options do I have?

You can revoke a receipt of payment based on a direct debit mandate issued to your bank up to the day before the debit is made. You can have amounts already debited reimbursed by your bank up to 8 weeks after your account was debited. You must object to the direct debit from your bank. In online banking, this is often possible in the sales overview by clicking on a button next to the corresponding payment item.

Exception: You can even return unauthorized SEPA direct debits (i.e. without a mandate) up to 13 months after they were debited.

It is important that you regularly Check your account statements once a month for accuracy.

What happens if a direct debit is not honored?

If your account does not have sufficient funds and you do not have an overdraft option, a direct debit cannot be honored. This is colloquially called a “broken” direct debit. Your bank will then inform you and the creditor's bank that the direct debit could not be honored. You should then contact the creditor and clarify how you can make up the payment. Otherwise you risk a warning letter.

In the current account contract, your bank can agree with you that you have to pay a fee if the bank was unable to honor the direct debit of a creditor who has a direct debit mandate.