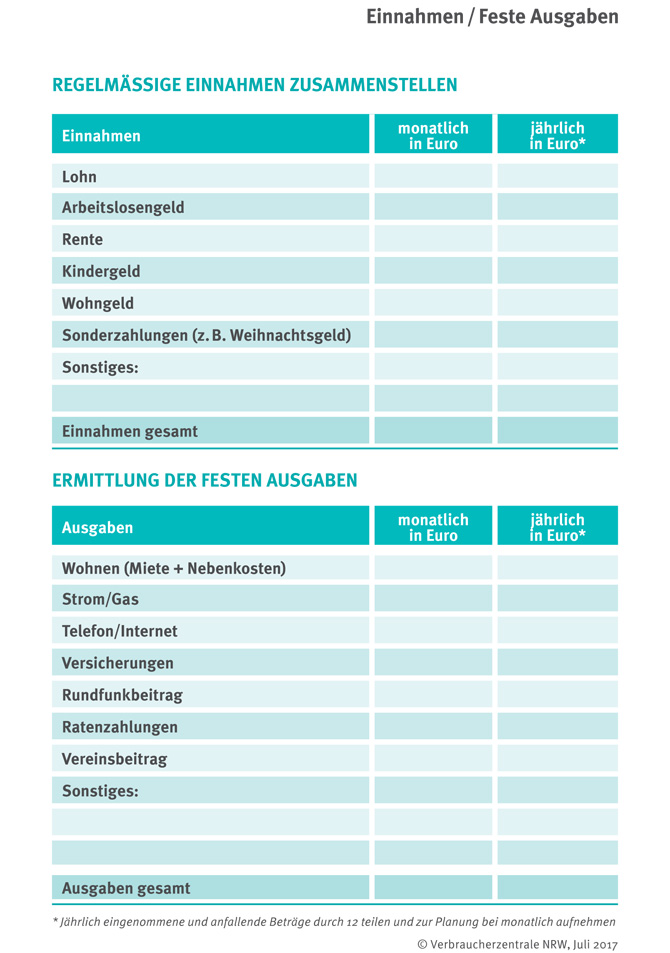

You only have to do steps 1 and 2 once and can use the amounts in the following months. Unless something changes.

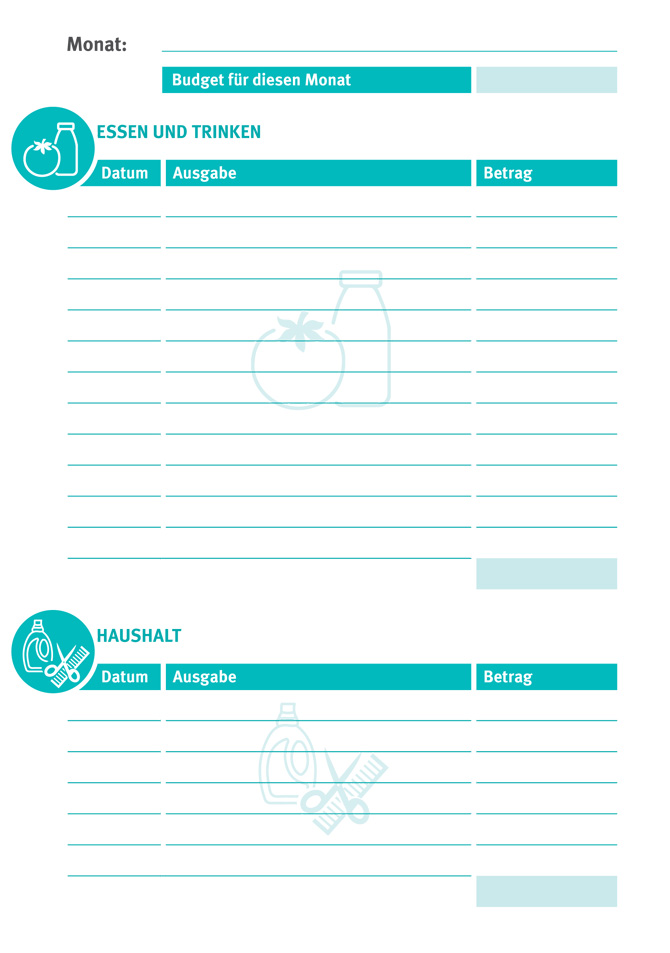

Step 3: Determine the budget for variable expenses

Income – Fixed expenses = available budget for variable expenses or “the money to live on”. Tip: Divide this amount by four and you'll know how much money you can spend per week to avoid going into the red.

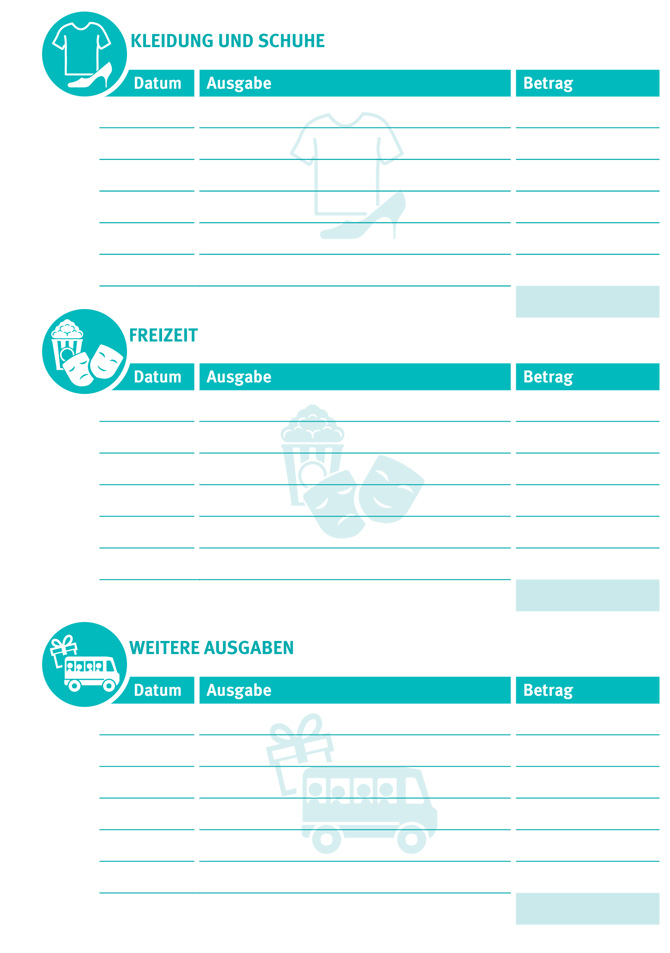

Step 4: Write down all variable expenses

Record variable expenses as completely as possible. For a better overview, the expenses are divided into categories such as “food and drink” or “clothing”.

Tip: Collect purchase receipts and don't forget even smaller amounts. Write down small amounts for which you do not receive a receipt on a piece of paper. Purchases that are paid for by card and are debited from the account at some point also belong in the budget planner. Otherwise the accounting will end up not being correct.

Collect receipts and notes in a box, take time once a week and enter them into the budget planner.

Step 5: Take stock – once a month

Add up the variable expenses and subtract this sum from the available budget.

Example:

1875 € available budget

– €1720 variable expenses

= €155 for reserves

Is the result positive? Goal achieved! Now you have the opportunity to save this amount for purchases, the emergency fund or retirement planning.

Is the result negative? Think about where or in which category you can save. You may notice that a lot of money has been spent on eating out. You could counteract this by preparing more yourself and planning your shopping.

Keeping a budget book doesn't necessarily help you make more money. There is limited scope, especially when income levels are tight. However, you can, firstly, understand where the money is disappearing and, secondly, better control it. You decide how you use your money. And last but not least, this gives you the opportunity to set aside specific amounts for necessary purchases or for your emergency fund.

Example tables